Ever Wonder What Type of Life Insurance is the Best for Your Family?

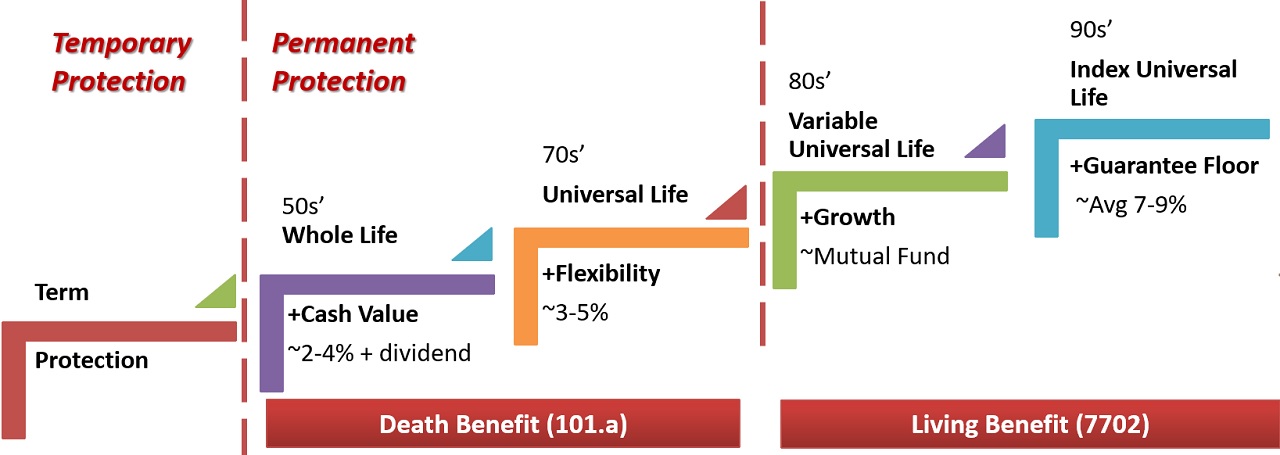

Insurance products have been updating just like everything else around us. Are you aware of the newest types and the difference between them? Everyone knows there are the temporary and permanent types but what is the best option for your family? Many people are not aware there are investments such as mutual funds inside these policies and the growth is TAX FREE! There is also the indexed type which allows you to participate with the market with downside protection. What does that mean you say? It means when the market goes up, your money goes up with it. When the market drops, you are not affected by it. Sounds great, doesn't it?

Our advisors will help you select the best type of insurance for your family. Working with 30+ insurance companies, we will find the most suitable type of plan without any bias.

What is Long Term Care and Why Do We Need It?

Here are some statistics on the things we insure. Most of us do not insure on long term care while the odds of us needing it are the highest. If we really think about it, what is more important? Is it our home? Our cars? Or our lives?

About 60% of the U.S. population will eventually need long term care. The national average cost is $203/day, $75,000/year. Average usage is 3 years of services for 92% of the claims.

Most people mistakenly think their health insurance will take care of this but do not realize it mostly takes care of the short term cost; it will not cover the long term care cost. People end up depleting their life savings to pay for this cost and end up not being able to retire.

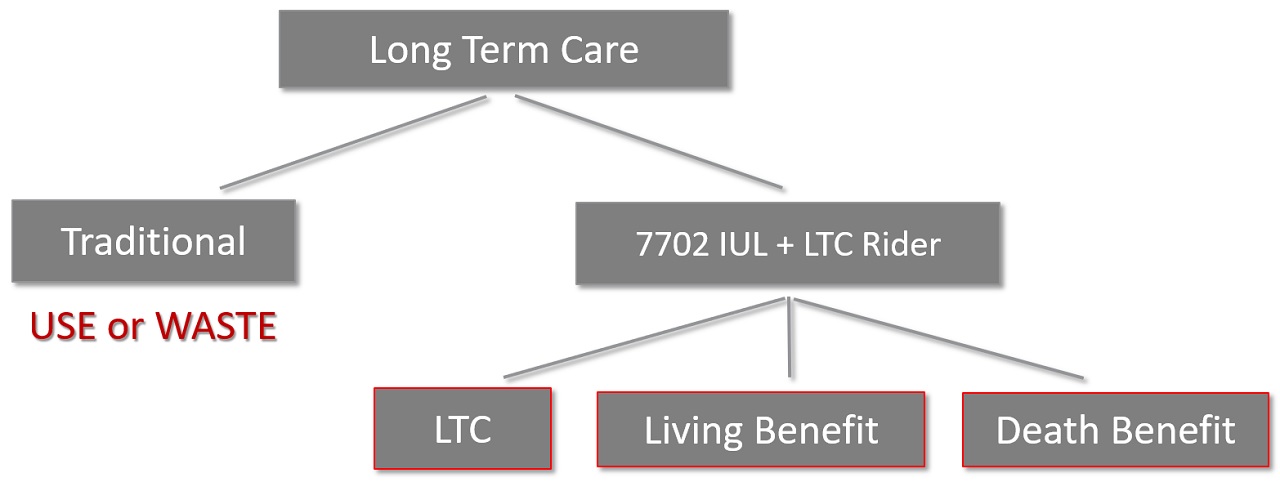

Now that we are aware of this, how to prepare? Traditionally, long term care insurance is like term insurance where if you do not use it, then you lose it. Did you know that the newer type of life insurance policies now offer LTC as a rider? What this means is it will lower the premiums significantly and will last until age of 120.

What Are You Paying for Your Auto and Home Insurance?

Most of us already have auto and home insurance but how do we know if we are getting them at the best price? Wouldn't it make more sense to compare with other providers? Just like when we are ill, we seek second opinions. Why not do the same with insurance?